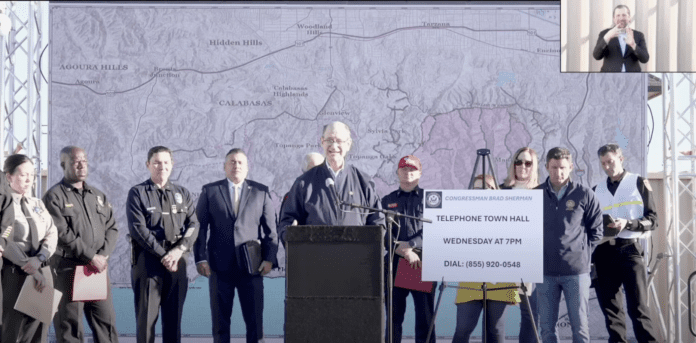

32nd District rep discusses federal disaster relief, housing aid, and SBA loans for victims of local blazes

As he scurries from meeting to meeting in his 32nd Congressional District, Brad Sherman is attempting to inform and assist his constituents, many of whom are victims of the devastating fires in and around Malibu and have lost their homes or businesses, and others who are evacuated and displaced but hope to return to properties that have not entirely succumbed to the horrific fires that ravaged Eastern Malibu, Pacific Palisades and are still not entirely extinguished.

The Malibu Times caught up with Sherman, seeking information regarding the status of Malibuites getting federal aid to assist them in disaster recovery and seeking answers for those who want to know when they can repopulate Malibu, Palisades, and nearby communities.

“I spoke with President Joe Biden by phone on Jan. 8 and thanked him for declaring the Palisades Fire, the Eaton Fire, and the other ongoing fires as part of a national disaster, an act that helps those affected to qualify for federal aid in addition to helping the various political subdivisions that are fighting the fire to seek compensation for those costs,” Sherman said. “Further, I expressed my concerns to the president that if at all possible, he should include those affected by the Franklin Fire in that declaration, and I note that in his letter to the president. Gov. Gavin Newsom included the Franklin Fire as well as any fires subsequent to the Palisades and Eaton fires in the next few days should they ignite in his request for federal relief for the ongoing fires.”

Managing expectations

Despite his perseverance in seeking entitlement to federal funds relief for those affected by the Franklin Fire, Sherman stated he wanted to manage victims’ expectations.

“It is by no means a slam dunk or certain that those who suffered in the Franklin Fire can obtain the same federal relief as those affected by the Palisades, Eaton and other current fires,” Sherman said. “The concerns center on the fact that the Franklin Fire occurred in early December and is not related to the same wind events we are dealing with now and, further, there is consideration given to whether the Franklin Fire can qualify for federal declaration-related relief on its own, which is an important consideration in the determination.”

Noting that he is pushing to get the Franklin Fire victims included, Sherman stated, “It is incongruous that if a person’swhole community burns down, including his home, the federal government is there to provide financial relief, but if your own individual home burns down and you are not in an area that qualifies for financial relief, you are left on your own. I’m doing all I can for the Franklin Fire victims.”

Following the money-relief for families and individuals

As an accountant by profession, Sherman is a good man to speak with about the financial aspects of seeking federal relief when one suffers a fire or other disaster loss. He provided a plethora of very useful information for readers.

First, he noted, FEMA provides special needs grants to households in the amount of $770, money that affords immediate relief to pay for necessities such as water, food, transportation, and hygiene and transportation.

“Affected residents can also qualify for $43,600 of housing assistance from FEMA and if they qualify for that, they will probably also qualify for an additional $10,000 in housing aid from the California State Supplemental Grant program,” Sherman said, noting that the website for the state-funded relief is at cdss.ca.gov/inforesources/disaster-services-branch/disaster-grant-assistance.

“Further, victims can also seek a FEMA grant of up to $43,600 in addition to the FEMA housing assistance and those funds are for people’s ‘other needs,’ attributable to being a fire victim, such as paying to replace a car or medical expenses,” Sherman said, noting that all of those funds are grants that do not have to be paid back, as opposed to SBA and other loans that qualifying victims can obtain with a maximium 4 percent interest rate.

Loans for victims, both individual and business-related

“Small Business Administration loans can cover up to $100,000 of personal loss, such as furniture that is destroyed, clothing and automobiles and up to $500,000 of a homeowner’s real property loss such as for home repairs,” Sherman said, noting that second homes and vacation homes do not qualify for such loans. “Loans are up to 30 years and first payments and interest are deferred for the first 12 months.”

SBA loans for businesses are also available, Sherman explained, noting that loans of up to $2 million for business and nonprofits to assist in addressing uninsured physical damage and losses. “Loans are up to 30 years, with the first payment and interest deferred from accruing for the first 12 months, and there are also SBA Economic Injury Disaster Loans of up to $2 million for businesses and nonprofits with economic injury such as lost sales as a result of a disaster, with a maximum interest rate of 4 percent.”

Adding some qualifiers and other details, Sherman noted, “Those loans are only available if the SBA determines that a recipient is unable to obtain credit elsewhere. Further, the combined amount for both SBA loans cannot exceed $2 million. To apply for the loans, go to sba.gov/funding-proframs/disaster-assistance/california-wildfires.”

As we wrapped up the interview, the congressman was off to other meetings and promised to keep constituents informed with regard to other assistance opportunities.