An Orange County man pled guilty after federal prosecutors said he received more than $5 million in covid-19 relief loans for three fake shell companies. Raghavender Reddy Budamala, 35, used the sham companies to apply for Paycheck Protection Program and Economic Injury Disaster loans, according to the plea agreement filed in U.S. District Court on June 3.

Budamala pled guilty to one count each of money laundering and bank fraud; and agreed to give all of his “ill-gotten gains” back to the government.

His lawyer, Diane C. Bass, told news sources she had no comment on the case.

According to the plea agreement, Budamala formed or acquired three shell companies in 2019 with no operations — Hayventure LLC, Pioneer LLC, and XC International LLC.

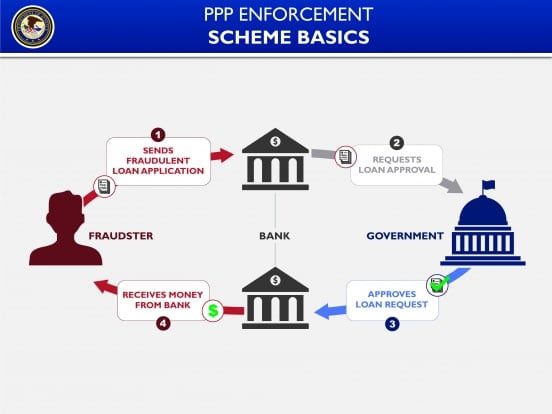

The Paycheck Protection Program (PPP) and covid-19 Economic Injury Disaster Loans (EIDL) were offered through the Small Business Administration (SBA) in the early months of the pandemic to help businesses survive shutdowns and quarantines. The loans had minimal interest and were forgivable, so long as the funds were used on specific expenses, like rent or payroll.

Budamala submitted seven applications to the SBA from April 2020 through March 2021, falsely representing to the banks administering the covid-relief business loan programs that his companies employed dozens of individuals and earned millions of dollars in revenue, and that he needed the money for payroll and business expenses.

Budamala ultimately received six loans totaling $5,151,497, according to the plea agreement. He was accused of using the funds to purchase a $1.2 million “investment property” in Eagle Rock, a nearly $600,000 property in Malibu, a “personal residence” in Irvine, and a $970,000 investment in an EB-5 Immigrant Investor Visa Program. He then deposited nearly $3 million of the remaining loan money into his personal TD Ameritrade account, according to a news release from the U.S. Attorney’s Office for the Central District of California.

The Orange County resident had then applied for loan forgiveness on several of the loans, claiming the money from the SBA was used entirely to meet payroll, the release said.

However, the addresses listed for the companies “were bogus, nonexistent or residential,” prosecutors said in the release.

“The states where Budamala’s companies purportedly operated have no records of those companies paying wages to any employees, and bank records for the companies reflect no significant business income or operating expenses,” the release stated.

Budamala has been in federal custody since his arrest on Feb. 23, when he tried to flee to Mexico, according to the release. He faces a maximum 40-year prison sentence.

IRS Criminal Investigation, the FBI, and the Small Business Administration’s Office of Inspector General investigated this matter. Assistant U.S. Attorney Gregory D. Bernstein of the Major Frauds Section is prosecuting the case.

Budamala is among an increasing number of individuals being charged with receiving covid-19 relief loans under fraudulent circumstances, according to a release from the Department of Justice.

U.S. Attorney General Merrick B. Garland created the covid-19 Fraud Enforcement Task Force in May 2021. In a March 10 press release, the U.S. Department of Justice reported that, “civil enforcement efforts to combat covid-19 related fraud…have to-date resulted in criminal charges against over 1,000 defendants with alleged losses exceeding $1.1 billion; the seizure of over $1 billion in Economic Injury Disaster Loan proceeds; and over 240 civil investigations into more than 1,800 individuals and entities for alleged misconduct in connection with pandemic relief loans totaling more than $6 billion.”

TMT was unable to identify exactly which property in Malibu was purchased by Budamala, but with a $600,000 price tag, it was most likely a vacant lot.