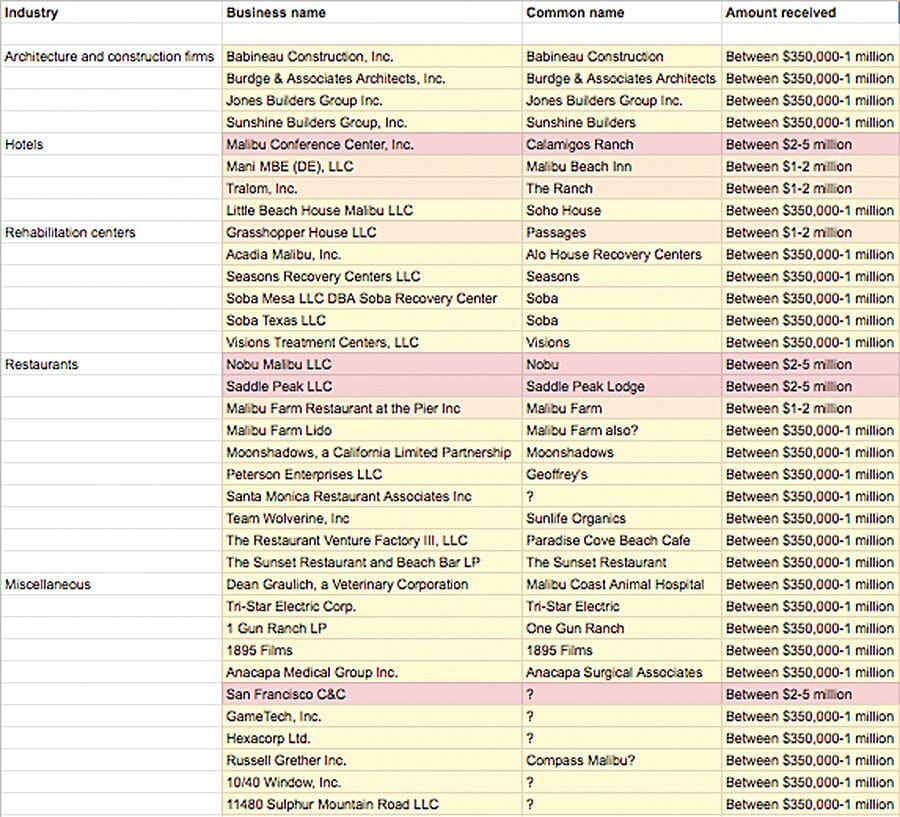

Government filings released Monday, July 6, revealed that high-end, visitor-serving Malibu businesses such as Nobu took up to five million dollars in Paycheck Protection Program (PPP) loans, while other smaller businesses received much less.

A total of 36 Malibu businesses were listed as having been granted at least $150,000 in PPP loans, offered as a result of business shut-downs due to the novel coronavirus pandemic. Most recipients fell into four categories—construction companies, hotels, restaurants and rehabs—but other well-known Malibu businesses such as Malibu Coast Animal Hospital and Tri-Star Electric were on the list, too.

The $660 billion PPP effort allowed for small businesses to apply for loans through local banks, which granted businesses two-and-a-half times their monthly payrolls. If loan recipients use their awarded funds to retain employees, pay rent or maintain utilities, they may apply for loan forgiveness later this year. The PPP has so far saved 51 million jobs nationwide, according to the Trump Administration.

“We definitely needed those funds to get us over the hump,” David Marler, the CFO of Malibu Coast Animal Hospital, said in a recent interview with The Malibu Times. When the pandemic first hit, the and the husband-and-wife owners of the business took pay cuts to ensure they could make payroll. PPP funding came through about a month later.

The PPP’s initial roll-out in March triggered a scramble for funds, which was hampered by a complex application process and pockmarked by technical issues. The program has since fallen under further scrutiny for awarding millions to corporations.

Malibu Coast Animal Hospital did not make the first round of funding, though they applied on the first possible day. Reading that major corporations had received millions was troubling for them.

“But we also understand that there weren’t a lot of rules out there telling you what you could and couldn’t do. People just were told to apply so they applied,” Marler said. “The first day we applied, I talked to one of the bankers and he said they had something like 30,000 loans come in where you typically would have had 300.”

The Small Business Administration (SBA) system was overwhelmed, which led to larger corporations such as the Los Angeles Lakers coming under fire for utilizing the PPP.

Nobu is one such business. The luxury sushi restaurant and hotel chain, which has 32 locations in places such as New York, Tokyo and London, took 14 loans across the U.S. for as much as $28 million. Actor Robert De Niro, celebrity chef Nobuyuki “Nobu” Matsuhisa, and film producer Meir Teper own the chain.

FOX Business cites De Niro’s net worth as $500 million, based on a quote from his ex-wife’s divorce attorney. But multiple outlets have reported that the actor’s finances have been “decimated” by the coronavirus. Nobu lost $3 million in April and another $1.87 million in May, Caroline Krauss, De Niro’s lawyer, said during recent legal proceedings.

Nobu’s Malibu location took out between $2-5 million worth of loans from New York Business Development Corporation. Yet the SBA data shows that Nobu retained zero employees. It is possible Nobu may have used their loans to pay rent, which would then allow the company to qualify for loan forgiveness. Alternatively, Nobu may simply be planning not to apply for forgiveness at all. The company would not have to begin paying back their loans until next year at the earliest. There is also the possibility the number is a typo or data error. Nobu representatives could not be reached despite repeated requests for comment.

Some of Malibu’s high-end rehab and recovery centers were among the city’s biggest PPP beneficiaries, including Passages, Alo House and Seasons. So were luxury visitor-serving businesses such as Calamigos Ranch and Little Beach House Malibu, which is a Soho House private club.

The SBA made the PPP data public after intense public pressure. Yet the SBA released only the data for businesses that applied for loans totaling more than $150,000, which means the names and loan amounts for more than 85 percent of PPP recipients (including The Malibu Times) are still not available to the public.

The list shows only businesses that were approved for PPP loans by delegated lenders, the SBA clarified in an attachment to the data: “The lender’s approval does not reflect a determination by the SBA that the borrower is eligible for a PPP loan or entitled to loan forgiveness.”

The SBA also specified that data also does not show which companies returned their loans, such as Shake Shack, which returned the $10 million it received in April after much criticism. The SBA said it will automatically review all loans over $2 million.

Though many local businesses, including Malibu Coast Animal Hospital, are not operating as they were before the coronavirus pandemic began, some are on their way back to solvency, boosted by spring’s PPP funds.

Lack of travel means that many no longer needed to board their pets, which negatively affected Malibu Coast Animal Hospital because boarding makes up 30 percent of their business, Marler said. Yet the coronavirus has also meant that more people are staying home with their animals, noticing limps or coughs in them that they’d never caught before. That, in turn, has resulted in an uptick in general veterinary services performed by Malibu Coast and an increase in care for Malibu’s four-legged residents.