In his only public appearance in the Los Angeles area while visiting the United States, 2006 Nobel Peace Laureate Dr. Muhammad Yunus addressed the Pepperdine University Law School on Saturday, with a practical message for achieving social good.

In his introduction of Yunus, Kenneth Starr, law school dean, summed up the problem in Bangladesh that Yunus addressed, saying, “The banking system, simply, was unjust.”

Yunus, who pioneered the idea of microcredit with uncollateralized loans in small amounts to millions of the poorest people in a poor nation, Bangladesh, spoke to a standing-room-only auditorium.

“A charity dollar has only one life,” Yunus said. “But a dollar spent in social business recycles. It is very powerful.”

Yunus proved just how powerful with his launch of Grameen Bank in 1983 – a revolutionary idea of loaning small amounts of money to subsistence-level people in local villages to help start their own businesses. His idea initially was met with overwhelming skepticism.

“I talked to the poor vendors in my village,” Yunus said, speaking in the melodic-accented English of his country. “I found that the 42 people who had borrowed from the moneylenders owed a total of $37. Their profit was perhaps a penny, so they were never able to be free from debt.

“I was astounded at what humiliation poor people would go through for such small amounts of money,” Yunus reflected. “As a university professor in economics, we talk about billions of dollars and five-year investments and so forth. I wondered about my relevancy.”

So he paid the poor vendors’ aggregate debt and encouraged them to further entrepreneurial heights. “It occurred to me that, if I could do this for just $37, what good could I do for a little more?”

Thus was born the idea of providing banking services in poverty-stricken neighborhoods. But when he encouraged local banks to lend to the poor, they laughed. “They told me you can’t lend money to the poor. They’re not credit worthy,” Yunus said. “So I offered myself as a guarantor.”

Yunus found that his co-borrowers repaid everything they owed and were hungry for more credit opportunity. So Yunus launched Grameen Bank, the founding of which took six years and countless hours arguing with traditional banking and regulatory agencies, and eventual new laws written for microbanking practices.

Yunus said he didn’t have a “particular strategy” for Grameen.

“But, looking back, I would just do the opposite of whatever regular banks did,” he said. “If they asked for collateral, we did not. If they have you sign a bunch of papers, we worked with illiterates. Regular bank managers told me to kiss my money goodbye.”

To the contrary, Grameen Bank has grown to an institution that has issued more than $6.5 billion in loans, individual ones at generally less than $100, to more than seven million borrowers. “We have had less than 1 percent of our borrowers default,” Yunus said.

And, in a country where illiteracy reigns and women are generally regarded as second-class citizens, nearly 97 percent of those loans have gone to women.

“It makes perfect sense,” Yunus said. “For centuries, men would bring their salaries home to their wives and women had to run their households with whatever was given them. They became perfect money managers.”

It wasn’t easy to convince the poor women of the village to accept bank loans. Conservative clergy told them they would not receive Muslim burials.

“There were some women who refused to even touch the money, saying to give it to their husbands,” Yunus said. “But when a woman said no, this was not her voice. It was fear speaking.”

Yunus said the bank encourages informal groups to apply for loans together and act as co-guarantors for repayment.

“Today, Grameen Bank is owned by poor women. Our board is all women and the director is a woman. All who were lifted out of poverty by their own efforts.”

There are more than 2,500 branches of Grameen open in Bangladesh now.

“We give them no capital to start the bank,” Yunus explained. “They must find the depositors in their village and run it themselves. They must break-even within 12 months. They never fall short.”

So successful was Grameen’s concept that it has diversified into providing education and health loans, and equities projects that bring computer and Internet services to small villages. Grameen has funded scholarships to more than 18,000 doctoral students. Grameen Phone has brought cell-phone ownership to more than 250,000 of the rural poor since 1997.

After his Nobel award, Yunus thought to bring his message of empowerment for the poor to these shores and is opening the first branch of Grameen America in Queens, NY next year.

His targeted clientele are the immigrant and working poor families who traditionally are refused normal banking services and must rely on check-cashing companies or pawnshops, which charge high fees. “From New York, we will move to help other inner cities, Appalachia, Native Americans. All humans are entrepreneurs, if you give them a chance,” he said.

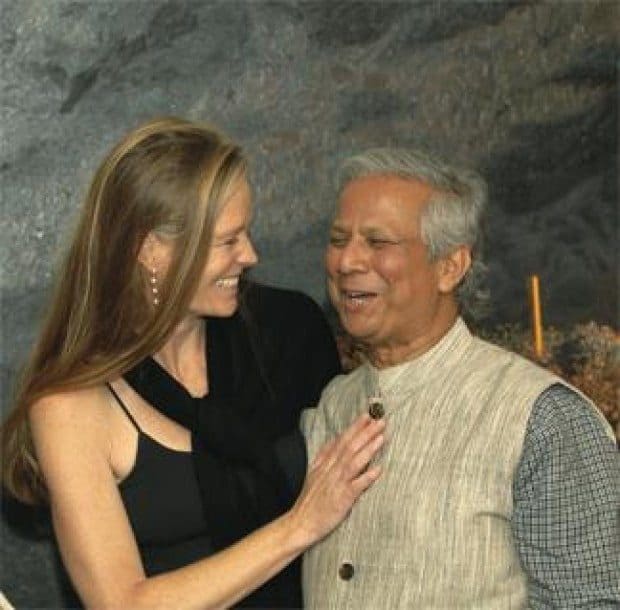

Yunus had been scheduled to speak at a fundraiser Sunday evening for Malibu’s MUSE Elementary School at the home of director James Cameron and his wife Suzy Amis Cameron. Because of the fire, they were forced to evacuate.

Undaunted, they moved the event to Cameron’s Santa Monica’s offices, where attendees heard Yunus, along with Zebiba Shekhia, who helps direct MUSE’s Global Scholarships, Charlie Gay of the Mineseeker Foundation and MicroCredit Summit Founder Sam Daley Harris.

After telling the story of a six-year-old boy sold to a fisherman by his parents in Indonesia, Harris said, “Our goal is to lend money to 100 million of the poorest families in the world. I am convinced that microcredit will free these people from servitude.”